Receive the latest news, updates and insights from us direct to your inbox. Subscribers to our newsletter also receive invitations to our exclusive events.

Market-ready UK compliant funds setup in

12 weeks through our fund hosting platform

Fund hosting service

We offer a Gibraltar regulated fund hosting service to managers looking to launch regulated funds. The recent introduction of the post-Brexit Gibraltar Authorisation Regime (“GAR”) recognises the close alignment of Gibraltar's financial promotion regime with the FCA’s. As a result, under UK FCA exemptions, funds may be promoted to sophisticated and institutional investors in the UK.

Our hosting service provides a platform that has the advantage of economies of scale and processes, streamlined by experience. Funds can be structured quickly and efficiently at a fraction of the cost with lower TERs and time-to-launch characteristic of established markets.

Agnostic as to investment strategy and underlying assets, the service is able to host the full range of equities, fixed income, currencies, commodities, real estate/property as well as crypto-tradable assets. We offer everything fund managers need to launch either closed - or open-ended funds leaving them to focus on their core skills - investment management and distribution.

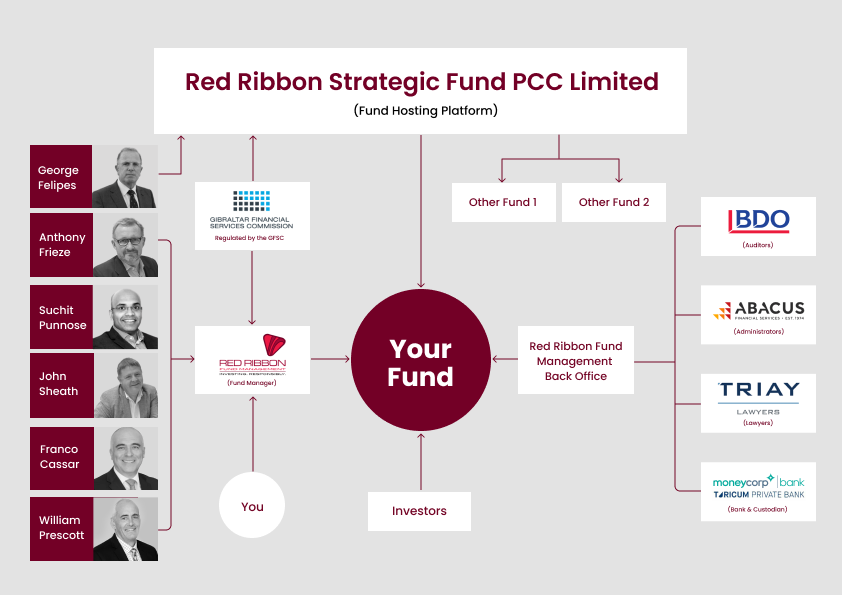

Fund hosting platform’s structure

Benefits of our structure

Low cost – The fixed fee package for a hosted fund starts from £50,000. Regulatory fees are complex, variable and often prohibitive for market participants. The package comes at a fraction of the cost of listing in other fund centres and reduces TERs.

Speed to market – We take advantage of the combination of our own economies of scale and the agile and specialised regime of the Gibraltar Financial Services Commission (GFSC) to minimise frustrating and expensive operational delays.

Reliable fund hosting service – Our team takes advantage of our regulatory permissions derived from our hosting platform to provide the highest levels of expertise and reliability. Performance delivery is rigorous and always monitored throughout the fund structuring process.

Turnkey solution – We interface with legal, regulatory and back-office service providers leaving the manager to focus on their core competencies - investment strategy, asset allocation, distribution, and investor relations. Our licence your fund strategy.

Frequently asked questions

What are the benefits of Red Ribbon Fund Management’s fund hosting service?

We offer a fast-to-market, hosting service to launch a regulated fund in 12 weeks on a fixed fee basis, starting at £50,000. Over several years our experienced team has been honed to provide an efficient service taking advantage of the agile regulatory environment and the economies of scale of our operations team. We are able to leverage the established relationships and processes with our lawyers and GFSC while liaising with 3rd party service providers such as administrators on our fund clients’ behalf.

What happens if another fund in Red Ribbon Fund Management fails?

Red Ribbon Fund Management’s funds in Gibraltar are offered as “cells” of Red Ribbon Strategic Fund PCC (Protected Cell Company) which, as its legal name suggests, ensures that assets and liabilities of each cell are entirely ring-fenced from the assets and liabilities of other cells. This provides the highest levels of investor protection against the – highly unlikely – financial failure of another cell.

Do we need to be regulated?

No; because our clients take advantage of Red Ribbon Fund Management’s own regulatory licence in Gibraltar. We hold what is known as Part 7 permission under the Gibraltar Financial Services Act 2019 to act as a Small Scheme Manager of alternative investment funds. Under this Red Ribbon Fund Management is able to make its fund hosting platform service available for asset manager clients who wish to offer alternative fund investment strategies to investors.

Who is responsible for distribution?

Asset managers retain their distribution channels to communicate with investors. They continue to be responsible for explaining their asset management strategies to purchasers of their funds and providing regular performance reports.

Can we distribute the funds and bonds in the UK?

Gibraltar’s financial promotion legislation covering the offering of funds to experienced investors is deemed to be equivalent to the UK FCA’s regulatory infrastructure. As such there is in effect a mini-Single Market between the UK and Gibraltar which means that the territory is the only jurisdiction on Mainland Europe that offers unfettered access to the UK market under the GAR - the Gibraltar Authorisation Regime.

Bond Issuing service

Red Ribbon Fund Management offers a regulated bond for your investors’ convenience: a Gibraltar-based bond registered with the GFSC brings wider investor visibility on IFA investment platforms among experienced investors and is also eligible for ISAs, QROPS, SIPPS and institutional investors such as pension funds. Moreover, Gibraltar’s financial promotion ensures a fully compliant bond prospectus delivering closely aligned equivalence with the UK’s regulatory landscape meaning you can also promote your bond to sophisticated and professional UK investors.

Frequently asked questions

Who takes care of the regulatory functions?

The Red Ribbon Fund Management hosting platform delivers regulated funds that meet the full requirements of Gibraltar’s regulator, the Gibraltar Financial Services Commission. Red Ribbon Fund Management’s responsibilities include liaising with our retained Gibraltar legal advisers, Triay Lawyers, to structure the fund. Under our regulatory responsibilities we have appointed two Experienced Investor Fund (EIF) Directors who have a fiduciary responsibility for the Private Placement Memorandum (i.e. the prospectus). They are required to ensure that this is drafted in accordance with the Prospectus Regulations that govern financial promotion and the Alternative Investment Fund Manager (AIFM) fiduciary rules that govern Red Ribbon Fund Management’s licence permissions and fund hosting service.

What are the benefits of RRFM's bond issuing service?

The benefits of launching bonds under our permissions include being able to offer a wide range of debt securities including corporate bonds, asset-backed securities, convertibles and structured securities. Moreover, there is no withholding tax on interest bearing instruments under the Eurobond exemption.

Download brochure

We'd like to keep in touch with news, reports and invitations to exclusive events regarding India. You can ask us to stop any time, if you do want to hear from us, please tick the box. You can find out about your rights and choices, and how we use your information in our Privacy Policy.

Subscribe to our newsletter

You can ask us to stop at any time! To know more about your choices, rights and how we use your information, please view our Privacy Policy